Our advantages

When we are called upon

About us

Legion Group International Law Firm - A legal organisation specialising in law! The Legion Group team consists of freelance consultants and specialists all over the world and in various fields: banking, law enforcement, intelligence services, international banking and financial regulators, leading specialists in cryptocurrencies and payment systems.

Due to the massive problems with online fraud, the founders and founders and managers of Legion Group International Law Firm have decided to open specialised departments and enter into contracts with various authorities, which will deal with and specialise in the recovery of online fraud funds

During the work of the special department, our team has managed to achieve the following results

Legion Group International Law Firm

Thomas Anderton

Clayton Parker

HOW WE WORK

Free consultation

Leave a request and our specialist will contact you shortly for a preliminary assessment of your situation. Reconciling your case with the one we already have in our case file

Collecting data and starting the process

Signing a formal contract for legal services. Collection of evidence of the broker's offence. Transferring your case to a lawyer who has already had experience of working with this particular broker

Return procedure

Finding the final recipient of the money you sent to the brokerage company. Drawing up documents and starting the process of returning the money using all kinds of tools and instances.

Result

Typically, brokers will voluntarily give back not only the deposit but also a portion of the investment income, if there was any, because the court may draw public attention. You receive the lost funds and pay for the work of a lawyer

our team -

the main squad

Customer feedback

about our work

Frequent questions and fears

What are the typical situations when it is worth applying for a refund?

There are a few common situations where you should consider filing for a refund. It's important to realise that any suspicion of financial misconduct can and should be investigated, and the sooner you act, the better the chances of a successful refund. of a successful refund.

Here are examples of such situations:

- Brokerage company or investment platform blocks access to the account

- If you are denied access to your investment or trading account, or the platform suddenly stops communicating, this is the first sign of a possible scam

- Requirements to pay additional fees for withdrawal of funds

- If a broker requires you to pay ‘additional commissions’, ‘taxes’ or any other fees to be able to withdraw funds, it could be a ploy to defraud you.

- Unreasonable delays in withdrawal of funds

- Delays without explanation and ignoring your withdrawal requests may indicate that the company is unscrupulous.

- Offer to invest in 'guaranteed profitable' projects

- In the real world, there are no investments with guaranteed returns. Promises of super-high returns without risks are the main sign of fraud.

- Use of pressure and threats

- If a broker or platform representative demands additional contributions under the threat of account freezing or blocking, you should immediately stop the interaction and seek help

Contact us if any of these situations sound familiar to you. Our job is to protect your rights and recover your money legally.

What are the procedures and timelines for processing a chargeback?

The refund process usually takes between 1 and 14 days, however each case is different and may take longer depending on the complexity and circumstances of the case.

Here are the main stages that our specialists go through:

- Initial consultation and case analysis

- At this stage, we will consult and analyse your situation free of charge. This takes 1-2 days. We collect information about the company or platform you have a problem with and check its reputation and history.

- Legal assessment and strategy development

- After the consultation, our lawyers develop a refund strategy, including the preparation of legal documentation. This stage usually takes 1-3 days.

- Interaction with financial structures and regulators

- We liaise with banks, payment systems or other financial institutions involved in the transaction. Thanks to our experience and partnerships with international regulators, we can expedite the procedure, which usually takes between 3 and 7 days. However, in complex cases, especially with international transfers or additional checks, this stage may take longer.

- Control and completion of the return process

- At the last stage, we monitor the execution of the return procedure and promptly resolve any issues that arise. This usually takes 1-4 days, but may be extended in individual cases when additional checks are required.

Note: In rare cases, such as when dealing with international organisations or complex multi-channel transfers, the return process may take longer than 14 days. organisations or complex multi-channel transfers, the return process may take longer than 14 days. We understand that every day counts for our clients and we always do our best to speed up the process, keeping you informed of all stages and deadlines.

When you contact us, you can rest assured that your case is treated with the utmost care and our experts make every effort to successfully recover your funds.

Would it cost too much to go to a lawyer?

Your concerns are understandable, but working with a professional legal organisation, especially one that offers payment on success, greatly reduces financial risk for clients.

That's why partnering with us is a safe and smart decision:

- Free consultation:

- Payment for results only:

- Transparent terms and conditions:

- Minimising your costs:

- High probability of success:

Through our co-operation with financial institutions, regulators and international partners, we increase the chances of a successful conclusion of a case.

Co-operation with us is not only safety, but also confidence that you will receive professional help without unnecessary costs.

Contact us today for a free consultation and

find out how we can help you!

What documents and information will I need to provide to start the refund process?

You will need to provide the following documents and details to enable us to start the refund process promptly.

These materials will help our experts assess the situation more quickly and choose the most effective strategy for the return:

- Transaction Confirmation

It is important to provide account statements, transfer receipts, and any cheques or receipts that show that funds have been transferred. This will help us identify the payments and determine their purpose.

- Contract and terms of service

If you have copies of the contract with the broker or investment platform, as well as any documents describing the terms of the transaction, they will be important for legal analysis. Screenshots of the terms and conditions stated on the company's website will also work.

- Screenshots and correspondence with company representatives

All of your communications with the broker or platform, emails and call records can be important evidence for understanding the situation and detecting fraud. It is advisable to save and provide screenshots, emails and text messages.

- Documents related to denial of withdrawal of funds

If you have been denied a withdrawal, it is important to keep all confirmations and correspondence where you are informed of denials, ‘additional fees’, ‘checks’ or other conditions put forward to block withdrawals.

- Personal data

We will need proof of your identity (passport or other document) so that we can formally represent you and deal with financial institutions.

- Any other information related to the case

Any additional information that may be useful (e.g. account details for refunds, mentions of names of company employees) will help speed up the process and increase the likelihood of success.

Important: During the refund process, we help you gather the necessary materials and will advise you if additional information is required. When you contact us, you can rest assured that all data is treated strictly confidentially and used solely for the purpose of recovering your funds.

What should I do if I don't have all the documents and evidence?

Lack of all documents and evidence is no reason to give up trying to get your money back. Our specialists know how to deal with such situations and will help you recover the missing data.

We are taking the following steps:

- Requesting documents: Our lawyers formally request missing data from brokers, banks, payment processors or other parties involved in the process.

- Working with partial information: Even a small piece of paperwork or correspondence can be helpful in starting a case and forming a strategy.

- Analyse transaction traces: We use financial tools and queries in payment systems to reconstruct the chain of your actions and evidence.

- Engaging partners and instances: Where necessary, we co-operate with regulatory bodies, registries and our obtaining additional data.

Even if you only have a recollection of the situation, that may be enough to start the process. We take on all the work of recovering the missing evidence so that you can get your money back.

Contact us for a free consultation - we will sort out your case and find the best solution!

If the Brokerage Company/Broker or other fraudster claims it was my own fault, do I stand a chance?

Yes, you have a chance to get your funds back, even if the broker or scammer claims that you are solely responsible.

Fraudsters and unscrupulous brokers often use manipulation to shift the blame to the client. They may refer to user agreements, emphasise your agreement to their terms, or claim that you yourself made rash decisions.

However, this is just part of their tactics to avoid accountability.

Our experts carefully analyse:

- User Agreement terms and conditions and identify hidden clauses that may have violated your rights.

- The company's methods of interaction with customers, including manipulation and pressure.

- Specific actions of the broker to identify violations, such as knowingly making false promises, refusing to withdraw funds or imposing additional investments.

If the analysis proves that the company acted irregularly or provided incorrect information, this will be a key argument for a refund.

Don't let scammers make you feel guilty. Contact a professional to protect your rights and recover your lost money.

If I contact you and we start co-operation, will you guarantee the successful return of my funds?

We understand how important the issue of warranty is to you, but there is no room for absolute promises in the practice of law.

Here's how we work to minimise risk and maximise the chances of success:

- Capability assessment:

In the first step, we analyse your situation free of charge. If the chances of success are minimal, we tell you straight away without wasting your time and resources.

- Guarantee of a professional approach:

We ensure that we put in our best efforts by utilising our experience, knowledge and professional connections. Our specialists work according to well-established methodologies and employ the best experts to achieve results.

- Payment for results only:

We do not charge upfront fees. You pay for our services only after successful completion of the case, which demonstrates our confidence in our competence.

- Transparency of work:

At every stage you will be kept informed of what is being done to recover your funds. We always inform you about possible risks and expected results.

We do everything we can to recover your funds, but our main advantage is our honest and realistic approach. Together we will increase your chances of success!

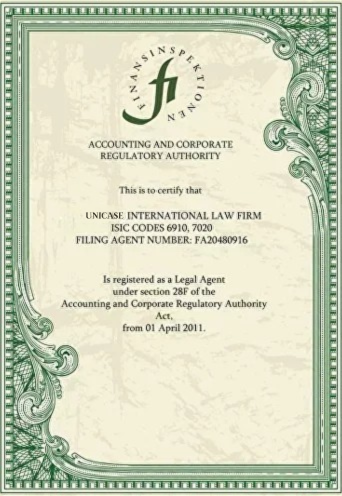

We're officially registered

signing the contract